Irs payroll calculator

Set up your evaluation process get feedback and more. IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax withheld following tax law changes.

Calculating Federal Income Tax Withholding Youtube

Federal Salary Paycheck Calculator.

. For individuals and businesses not for payroll tax deposits. In addition to other forms in certain situations. The pay period end date should be on your pay statement when the employer processes your pay for that period.

The W-4 requires information to be entered by the wage earner in order to tell their employer how. And Form 941 Employers Quarterly Federal Tax Return. It will help you as you transition to the new Form W-4 for 2020 and later.

That result is the tax withholding amount you should aim for when you use this tool in this example 50. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The reliability of the calculations produced depends on the.

Make payments from a bank account. It is contributed equally by employer and employee at. Manage recruiting appraisal expenses leaves and attendance easily with Odoo.

Compare the Best Now. Revenue Procedure 2004-53 explains both the standard procedure and an alternate procedure for preparing and filing Form W-2 Wage and Tax Statement. It will confirm the deductions you include on your official statement of earnings.

My entity is merging with another what do we need to do for payroll taxes. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Similar to the tax year federal income tax rates are different from each state.

The provided calculations do not constitute financial tax or legal advice. You assume the risks associated with using this calculator. The state tax year is also 12 months but it differs from state to state.

Components of Payroll Tax. This component of the Payroll tax is withheld and forms a revenue source for the Federal government Social Security Tax. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

We also offer. Pay Now by Card or Digital Wallet. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

It comprises the following components. You can use the Tax Withholding Estimator to estimate your 2020 income tax. This payroll tax component forms part of old age and unemployment benefits extended by the Federal government.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Some states follow the federal tax year some states start on July 01 and end on Jun 30. Affordable Easy-to-Use Try Now.

For help with your withholding you may use the Tax Withholding Estimator. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages.

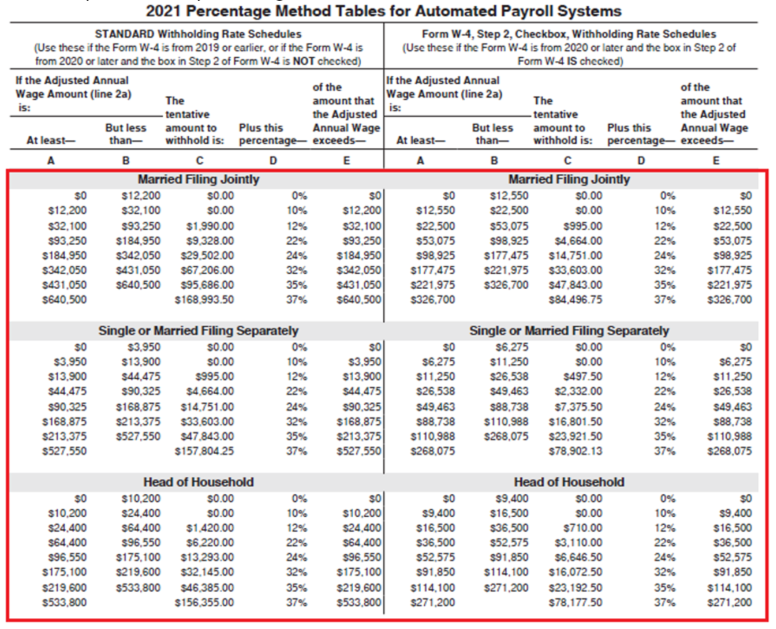

Use the Income Tax Withholding Assistant if you typically use Publication 15-T to determine your. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your. Doing a Paycheck Checkup is a good idea for workers with multiple jobs. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

250 minus 200 50. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. 250 and subtract the refund adjust amount from that.

Find 10 Best Payroll Services Systems 2022. Get the Latest Federal Tax Developments. We also offer a 2020 version of this calculator.

Ad The New Year is the Best Time to Switch to a New Payroll Provider. Switch to hourly calculator. This is a more simplified payroll deductions calculator.

Make Business Payments or Schedule Estimated Payments with the Electronic Federal Tax Payment System EFTPS For businesses tax professionals and individuals. Recommends that taxpayers consult with a tax professional. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

For example the pay period end date could be Friday January 17 but the paycheck for that period might not be received until the Monday of January 27. Then look at your last paychecks tax withholding amount eg. In this case you would use Friday January 17 as your input to that question.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. Ad Employee evaluation made easy. The information you give your employer on Form W4.

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay.

Irs Launches New Tax Withholding Estimator

How To Calculate Federal Withholding Tax Youtube

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Irs Improves Online Tax Withholding Calculator

Federal Updates

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Federal Withholding Calculating An Employee S Federal Withholding By Using The Wage Bracket Method Youtube

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Paycheck Calculator Take Home Pay Calculator

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

Calculation Of Federal Employment Taxes Payroll Services

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com

How To Calculate Federal Income Tax

Which 2020 Withholding Table Is Correct R Tax

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes Methods Examples More